Discover the story behind Wamda Capital and our mission to support and empower the next generation of entrepreneurs.

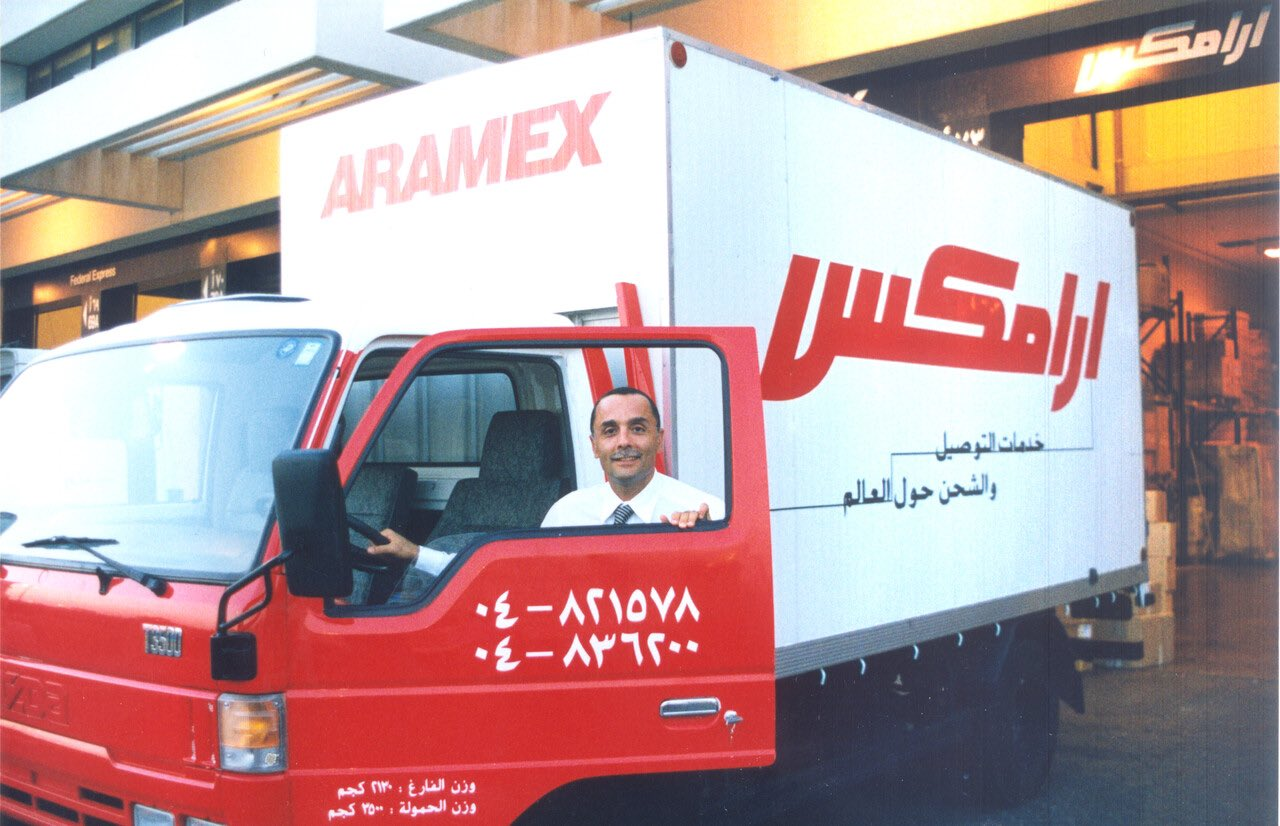

In 1982, Fadi Ghandour launched Arab American Express, which came to be known as Aramex. Aramex was the first Arab company focusing on delivering parcels coming from the United States to Middle eastern countries.

In 1997, Aramex became the first Arab company from the Middle east to list on a US stock exchange. That feat was only repeated in 25 years later.In parallel, Fadi takes a bet on two young entrepreneurs taking on the nascent online world. In one of the region’s first direct angel investments of its time, Fadi is a founding investor in Maktoob.

Considered as MENA’s first tech acquisition by an international incumbent, Yahoo’s acquisition of Maktoob in 2009 is a watershed moment for the region’s technology ecosystem.Off that successful first exit, Fadi launches MENA Venture Investments, the region’s first angel fund which will go on to back more than 110 companies across its 14 year lifespan.

Wamda was established in 2010 by Fadi Ghandour, who, after successfully exiting Aramex, his previous venture, shifted his focus towards helping accelerate the burgeoning entrepreneurship ecosystem in the MENA region.

The Wamda brand came to life with the launch of wamda.com, a free, bi-lingual, independent online platform that publishes articles related to the tech ecosystem in the Arab world. The platform covers a broad range of topics, including industry announcements such as startup fundraising and ecosystem stakeholder partnerships, in-depth analyses, research reports, podcasts, interviews, and other related content. To date, wamda.com has published over 18,000 pieces of content in both Arabic and English languages.

Wamda has also organized multiple in-person events, across various regional hubs, aimed at helping startup founders get in touch and connect with relevant business leaders and subject matter experts in order to expand their knowledge base, make better informed decisions, and build successful businesses. One such event was Mix & Mentor, which targeted early-stage startup founders and provided them with a platform to network and connect with key industry stakeholders in the Arab region

In 2015, Wamda launched Wamda Capital Fund I, one of the region’s first Venture Capital funds. The $70m fund was anchored by the IFC, with participation from Zain and other regional investors, and mandated to invest in growth stage businesses (series A and above) based in the Middle East, Africa, and Turkey. Some of the fund’s successful exits include Careem, Mumzworld, and Twiga.

As of 2019, Wamda Capital Fund I had been fully deployed and entered the process of harvesting. Subsequently, Wamda transitioned to investing through ‘Wamda Seed’ an early-stage evergreen investment entity backed by the personal capital of Fadi Ghandour and targeting sector-agnostic, Seed to Series A technology startups based in the MENAPT region. Its evergreen, solo capitalist structure allows Wamda Seed the freedom to seek opportunistic investments without a predefined fund lifecycle and provide patient capital to technology startups across a range of industries and locations. To date, Wamda Seed has invested in more than 67 companies, including Tabby, Eyewa and Hala.